Thus, the accounting treatment for the NCI ownership must abide by the consolidation method, whereby the REIT records the assets (and liabilities) tied to the NCI on its balance sheet.įor the sake of transparency, REITs maintain and report a separate NCI equity account in their filings, which is designed to reflect that a portion of the consolidated interests are not entirely attributable to common shareholders. Non-controlling interest (NCI) comprises operating partnership (OP) unit holders that have not yet converted their units into common shares. Non-Controlling Interest (NCI) – Consolidation Method The formula to calculate funds from operations (FFO) is as follows. M ost REITs adhere to Nareit’s formal definition and guidelines to compute FFO. Unlike many non-GAAP measurements, the funds from operations (FFO) metric does have a quasi “official” formula.

Financial Data Collection → Gather the values of the formula inputs from the SEC reports filed with the SEC (Net Income to Common Shareholders, Depreciation, Gains on Sale, and NCI Losses, net of Earnings).To calculate the funds from operations (FFO) metric, follow the four-step process outlined here. Cash Flow Statement (and/or Supplementary Disclosures).The following pieces of information are necessary to calculate the funds from operations (FFO). That said, the funds from operations (FFO) metric is a practical method to estimate the capacity of a REIT to maintain, or perhaps raise, its current payout of cash dividends.įFO Definition (Source: Nareit Glossary of REIT Terms) REITs must issue a significant proportion of their income to shareholders as dividends as part of their business model because of the regulations governing the REIT sector. REITs own and operate a portfolio of income-producing real estate properties, with holdings that span across a broad range of sectors, such as the residential, commercial, office, retail, and hospitality segments. GAAP reporting guidelines, to become more suitable for analyses on REITs. The FFO metric was originally developed by Nareit to reconcile net income, the accrual accounting-based net profit metric per U.S. The funds from operations (FFO) metric, in simple terms, measures the cash generated by a real estate investment trust (REIT). What is the Definition of Funds from Operations (FFO)? FFO and CFO bear some commonalities, yet FFO is an industry-specific metric intended to measure the operating cash of REITs without adjustments for changes in working capital, which pertain more to non-REIT corporations.The formula to calculate FFO reconciles net income starting with the add-back of the depreciation of real estate assets, followed by adjustments for non-recurring items, such as the gain (or loss) on an asset sale and impairments.

CALCULATING OPERATING CASH FLOW FREE

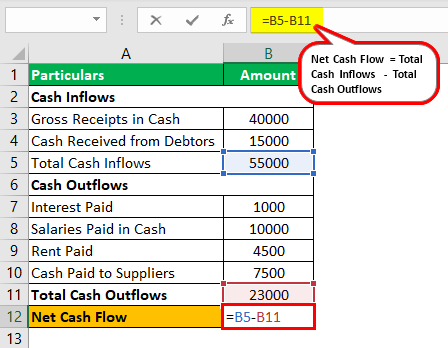

Many investors look to the free cash flow figure of a business to determine if it is worth investing in. When a company’s free cash flow steadily increases, it typically signals that increased earnings will follow. With these elements in mind, the free cash flow formula is as follows:įree Cash Flow = Net Income + Depreciation/Amortization – Change in Working Capital – Capital Expenditureįree Cash Flow = Operating Cash Flow – Capital Expenditures Capital Expenditure: The money spent on the business’s fixed assets, such as real estate and equipment, found on the cash flow statement.Working Capital: Refers to the difference between your business’s assets and liabilities, the cash left over for operating activities, found on the balance sheet.Depreciation/Amortization: The measurement of an asset’s value decreasing over time and the method of breaking down the cost of such assets over time, found on the income statement.Net Income: The remaining income after the total revenue or sales has covered all of the business’s expenses- net income is found on the income statement.

To determine free cash flow, you will first need to find a few key figures from your business’s income statement and balance sheet.

The FCF formula shows whether or not the company can grow its cash by investing, so businesses seek to have a high figure.

0 kommentar(er)

0 kommentar(er)